Navigating the Highs and Lows: The Power of Calculated Risks in Business

- Elsa Martinez

- Apr 22, 2024

- 2 min read

Updated: Jun 28

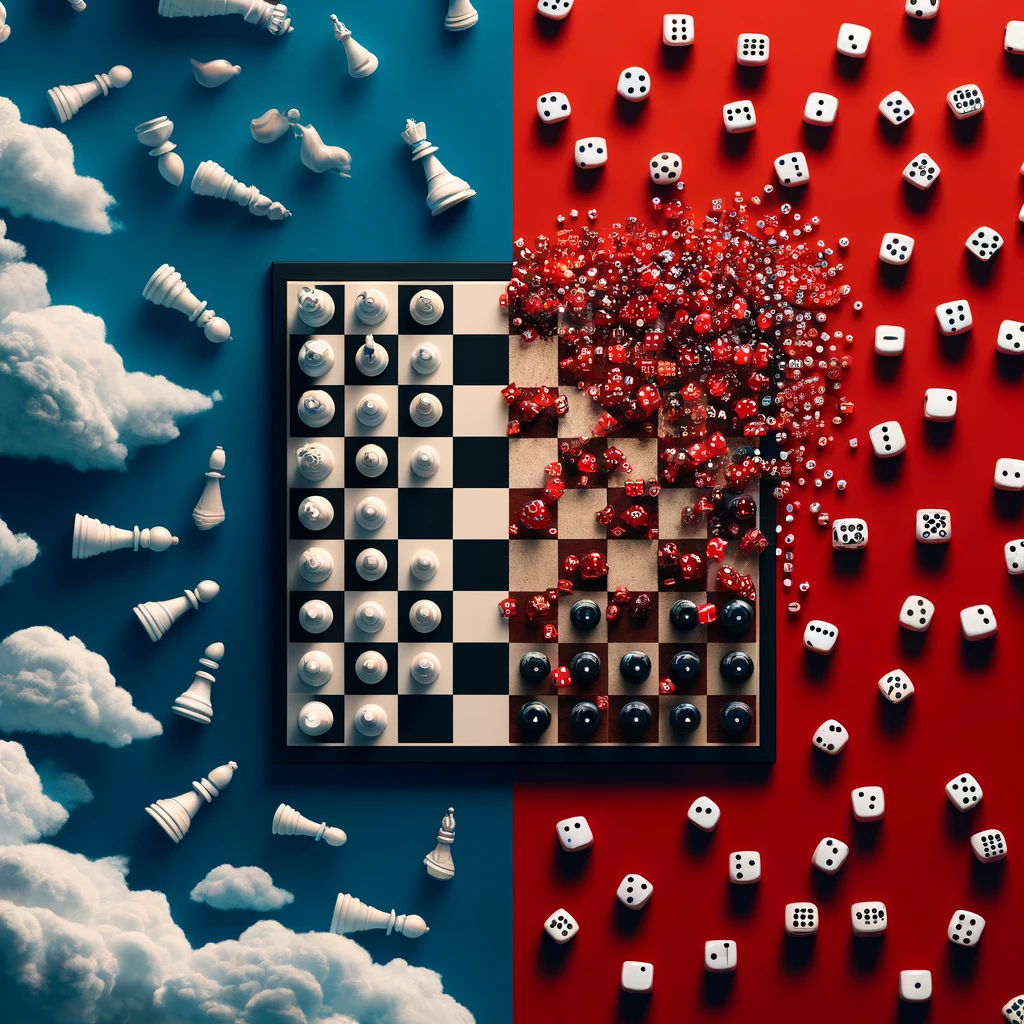

In the dynamic world of business, the concept of taking risks is often synonymous with opportunity. For entrepreneurs and business leaders, mastering the art of taking calculated risks is more than just a skill, it’s a necessary aspect of growth and innovation. Understanding and navigating the delicate balance between potential risks and rewards is crucial to making informed decisions that drive your business forward.

What exactly is a calculated risk? A calculated risk is a risk that has been thoroughly evaluated before any action is taken. This means assessing the potential benefits and drawbacks of a decision, backed by data and a clear understanding of the potential impacts. Unlike impulsive risks which often occur in the heat of the moment, calculated risks are based on careful consideration of all relevant data, potential impacts, and the likelihood of success or failure. Calculated risks include a strategic plan that includes realistic possible outcomes, risk mitigation strategies, and contingency plans, ensuring that all decisions are informed and proactive.

Then what are uncalculated risks? Uncalculated risks often occur as a response to immediate pressures or the temptation of quick gains and are often driven by emotions instead of careful analysis and strategy. Sometimes these types of risks lead to success, but more often, they result in major setbacks and failures and the results can be catastrophic.

Is there an art to taking risks in business? Maybe, maybe not, but there are some clear strategies you can take to minimize the potential pitfalls:

1. Research and Analysis:

Begin by gathering as much information as possible about the opportunity. This includes market research, competitor analysis, and financial forecasting. The more data you have, the better equipped you are to make an informed decision.

2. Assess the Potential Outcomes:

Consider both the best-case and worst-case scenarios. What are the potential returns on the investment? What are the risks involved, and how will they impact your business if things don’t go as planned?

3. Mitigate Risks:

Once you have a clear understanding of the potential risks, develop strategies to mitigate them. This could include phased rollouts, pilot programs, or securing insurance or guarantees.

4. Prepare for Contingencies:

Have a clear plan in place for potential setbacks. This includes having an exit strategy or a pivot plan that can be implemented if the initial approach does not yield the expected results. Having a plan B and even a Plan C is never a bad idea.

5. Measure and Adjust:

After taking the initial risk, continuously monitor the outcomes and be prepared to make adjustments or pivot altogether. Business environments are constantly changing, and flexibility is a key factor in leveraging the full potential of your risk.

Taking calculated risks is essential for any business aiming to thrive in the competitive business landscape. By carefully analyzing potential risks and rewards and preparing for various outcomes, businesses can more than just survive - they can thrive. Remember, always aim to maximize opportunities and minimize potential downsides when taking risks.

Comments